Investor Experience Index Q2, 2025: LP Takeaways

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

The Investor Experience Index provides a quarterly snapshot of how limited partners (LPs) rate their experiences with general partners (GPs). The data for this report is drawn exclusively from verified investor reviews published on Invest Clearly in Q2 2025.

When reviews are submitted to Invest Clearly, LPs provide an overall score but are also asked to rate sponsors across four specific data points:

- Pre-investment communication

- Post-investment communication

- Strength of leadership

- Alignment of expectations

These inputs create a more complete picture of investor sentiment. By analyzing correlations between category scores and overall ratings, the Investor Experience Index identifies the business practices that most directly impact satisfaction, trust, and repeat investment potential.

Below is our analysis and evaluation of trends observed in verified investor reviews in Q2, 2025. Here’s what LPs can learn from the data and the questions to ask sponsors when evaluating deals.

1. Leadership and Post-Investment Communication Go Hand in Hand

Leadership ratings showed the strongest correlation with overall investor satisfaction (0.96). Sponsors rated highly on leadership also earned near-perfect scores on post-investment communication, while low leadership scores consistently paired with weak communication.

-2.png)

What this means for LPs: Leadership performance is a strong indicator of LP satisfaction of the overall investment experience. When evaluating deals, look for strong leadership communication.

Questions to ask your GP:

- How does your leadership team stay visible and accessible to investors during the life of a deal?

- Who on your team is responsible for investor communication, and how often do you engage directly with LPs?

- Can you share an example of a time you faced a challenge mid-deal and how leadership communicated with investors about it?

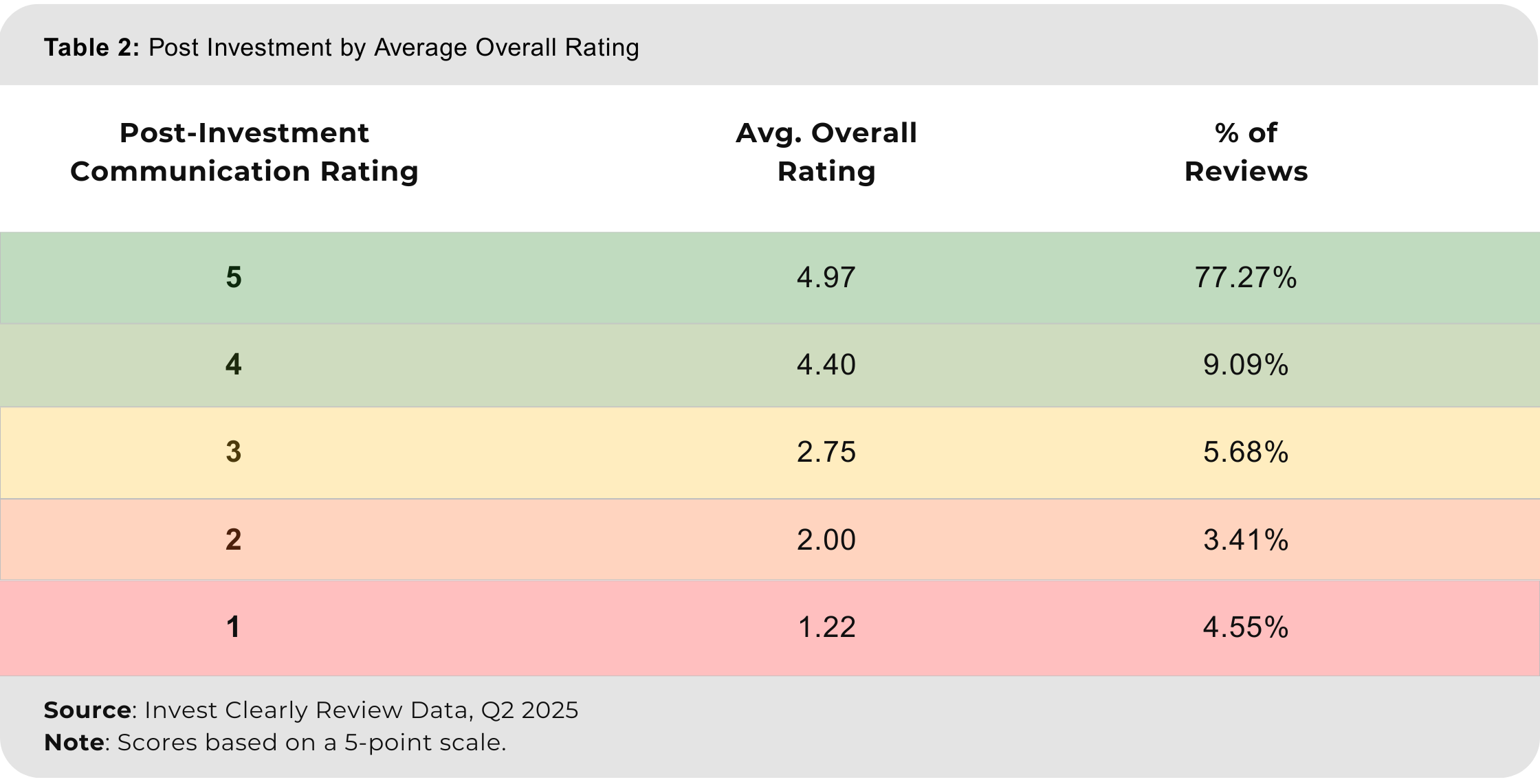

2. Post-Investment Updates Are a Make-or-Break Factor

When investors rated post-investment communication at 4 or higher, they gave overall sponsor ratings of 4 or 5 in 96% of cases. When communication was rated 3 or lower, only 16.67% of reviews remained positive.

What this means for LPs: Silence or inconsistent updates are deal-breakers. Most LPs feel that GPs cannot recover from poor communication. Sponsors who provide frequent, candid updates build lasting confidence, even when performance isn’t perfect.

Questions to ask your GP:

- What is your standard cadence for investor updates once a deal closes?

- What format do you use (written reports, webinars, calls), and how do you handle material negative news?

- Do LPs have direct channels to ask questions or raise concerns outside of scheduled updates?

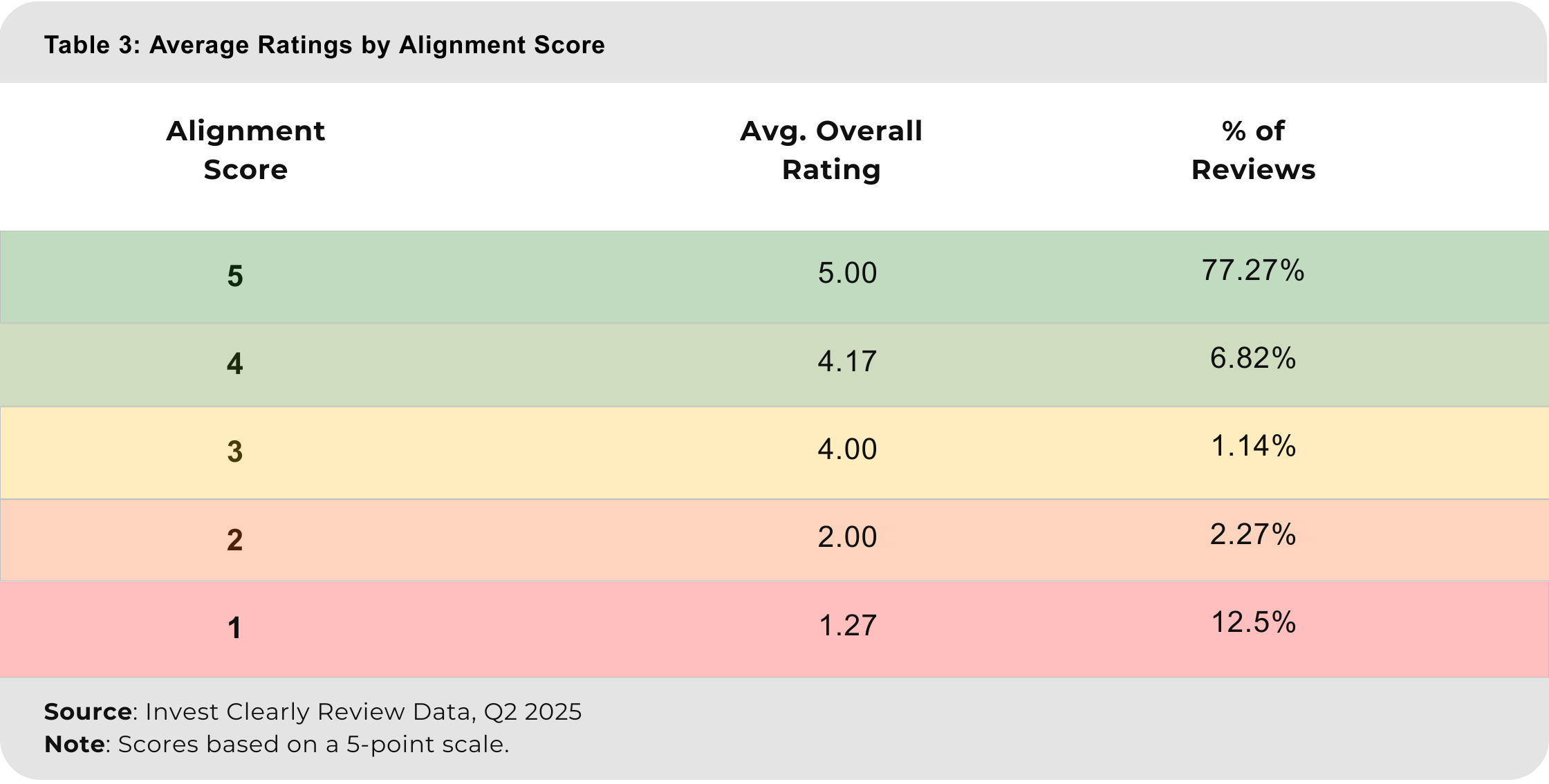

3. Expectation Alignment Is Non-Negotiable

When alignment expectations were met or exceeded (scores ≥ 4), overall ratings were always strong. But when alignment dropped below 3, only 7.14% of reviews still gave positive ratings. Misaligned expectations consistently eroded trust, even when returns were solid.

What this means for LPs: Sponsors who overpromise or gloss over risks set the stage for negative experiences. Be wary of returns that are too high and proformas with overly ambitious projections.

Questions to ask your GP:

- How do you set return expectations, and what assumptions are built into your projections?

- What risks or downside scenarios should I be prepared for in this investment?

- How do you reinforce expectations throughout the deal so LPs don’t lose sight of the original thesis?

Final Thoughts

On Invest Clearly, LPs see the overall sponsor scores from verified investor reviews. The Investor Experience Index reveals what drives those scores behind the scenes: strong leadership, communication, and clear alignment of expectations.

LPs should read reviews with these drivers in mind. Look at what fellow investors say (and how GPs respond), not just the final rating. Then, use targeted questions during due diligence to probe whether a GP’s approach aligns with the practices that consistently lead to higher investor satisfaction.

In other words: the overall score gives you the signal, but the reviews and your own questions give you the context. Together, they can help you make more confident, informed investment decisions.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

The Voice of the LP: Q3 2025

Analysis of Q3 reviews that uncover the lived investment experiences of LPs. Discover common themes in positive reviews and negative reviews, and use our analysis and the experience of other investors to improve your decision making.

Investor Experience Index Q3, 2025: LP Takeaways

Discover quarterly insights of how LPs rate their experiences with GPs. Get data-driven questions to use when evaluating GPs.

Real Estate Recapitalizations—What Passive Investors Need to Know

A recapitalization is a restructuring of a property's capital stack (the mix of debt and equity that finances an investment). While they can be legitimate business strategies, transparency can be an issue.

How to Evaluate a Potential Investment Using the FUND Framework

The FUND framework is a simple way to evaluate opportunities by looking at four pillars: Financials, Underlying Assets, Notable Differentiator, and Delegation of Responsibilities.

Why Syndications Remain My Investment Vehicle of Choice - Terence Critchlow

Terence Critchlow shares why he prefers real estate syndication. This article examines his rationale while addressing the constraints inherent to syndications.

From Land to Lease-Up: The Lifecycle of a Multifamily Development Deal for LPs

This guide walks you through the typical timeline of a multifamily development project from the LP perspective. Learn when investors come on board, what happens during construction and lease-up, and how profits are realized at exit.